-Updated April, 2022

Suz in Oslo; part of my 2 years of overseas travel ~ using credit cards and info for travel hacking!

Travel Hackers know a great deal about credit cards, how to use them for better travel experiences, and we’re always learning and keeping up with new great deals. Here’s a short list of recommendations for you to begin earning miles, points, hotel stays, and lots more benefits for travel. (If you’d like current updates and new info about credit cards info for travel before I get it on this page, sign up for the newsletter, below.)

Credit Cards – for Beginners:

To begin using credit cards to earn points for travel, use co-branded airline or hotel cards, or a general card that earns transferrable points. The Chase bank cards earn Ultimate Rewards (URs) and American Express cards earn Membership Rewards (MRs); both can be transferred easily to many airline and hotel programs. (Here’s an article explaining airline alliances and using credit cards for travel.)

Suz’s Favorite Credit Cards for Travel

Note that some credit cards can be used for cash back OR for points & miles. Here are some of my favorites, and why:

NB: When you sign up for a credit card through one of these links, I may earn points for referring you. (Thank you! – this enables me to continue operating this website and community for free.) See my full disclosure here.

My #1: Chase Sapphire Preferred Credit Cards

Big news! This card has a signup bonus of 60,000 points – enough for $1000 of travel!!!

Chase Sapphire Preferred (CSP) is the best recommendation for beginners who are getting started with a rewards credit card. The points are “Ultimate Rewards”; they are high value, and supremely flexible. You’ll get at least $1000 worth of free travel by signing up for this card! When you meet your sign up bonus (SUB), you’ll have earned at least 84,000 Chase Ultimate Reward points (URs), and in the Chase Travel Portal, you can redeem the points for an extra 25% of value. If you transfer those points to partners (e.g., Southwest, United, Hyatt, Marriott, among others), you could receive 2 – 5 cents of value per point.

The CSP comes with elevated rewards and perqs for travelers: 5x on travel, and 3x on dining worldwide. You get a $50 credit on hotels. Car rental insurance is covered, so you can save $10-15 per day if you rent using the CSP. Other benefits include baggage and trip delay, and trip cancellation. There are no foreign transaction fees, great for overseas travel.

*You can also redeem these points for cash or gift cards (60,000 points = $600 cash…not as good as the travel they buy). Note: with the Sapphire card, you can combine any URs you earn from any other card into this account!…which is why it’s high on my list. Click here for more info: Sapphire Preferred.

My #2: Chase Ink Cards

Earn 100,000 bonus points with the Ink Business Preferred® card or $750 bonus cash back with the Ink Business Unlimited® card or Ink Business Cash® card. Note: those cash back amounts can be 75,000 points!

Not normally viewed as a traditional travel card, the zero annual fee Ink Cash business card is a workhorse for earning tons of Ultimate Rewards… Though the points can be taken as cash back, the real value to this card is by transferring the points to a Sapphire card or the Ink Preferred card and then transferring the points to airline or hotel partners.

Take a look at the Chase Ink Unlimited, and Ink Preferred, too – all are outstanding cards! AND – you can have them all.

Earn 5% at office supply stores and on internet, cable and phones services with the Ink Cash (I use this to pay my Google Fi phone bill and to buy gift cards at office supply stores). Also – Earn 2% at gas stations and restaurants.

(PS – If you don’t have a traditional business and don’t know how to get a business card, I can help you figure that out. For instance, have you ever sold anything? email me for more info.)

My #3: Chase Freedom

Again, not traditionally viewed as a travel card, except by those in the know. The Freedom cards have no annual fee (AF), and can earn you tons of points…and, these are the very valuable Ultimate Rewards points. These cards offer 5% points back on gasoline purchases for the first year! Both cards give back 3% on dining and drugstore purchases. The Flex 5x categories change every quarter. And, remember, you can move these points to your Sapphire card! [For travel, don’t take cash back; take the points! They’re worth much more..]

There are also benefits for auto rentals, trip cancellation or delay as well. For a limited time, you earn $200 cash back (or 20,000 points) when you spend $500 in the 3 months after you get the card…it’s a great time to apply! Plus, free credit score report, extended warranties, and much more. Apply here: Chase Freedom.

Airline Credit Cards for Travel:

There are 5 different Southwest Airline cards for personal or business use. (If you want to know how to apply for business cards without a traditional business, let’s have a conversation about that!). I got my Southwest Companion Pass by getting sign-up bonuses with SW cards-very valuable! This means my traveling partner, whoever that may be, flies free with me (well, the companion must pay the $5.60 tax…).

The Annual Fees range from $69 per year to $199 per year, depending on the perqs you get with the card, which may include up to 9000 bonus anniversary points. Use this link to compare the 5 different cards: Southwest Airline cards

NB: as of August, 2021, earn 3x points on dining!

My #5: United Airlines Credit Cards

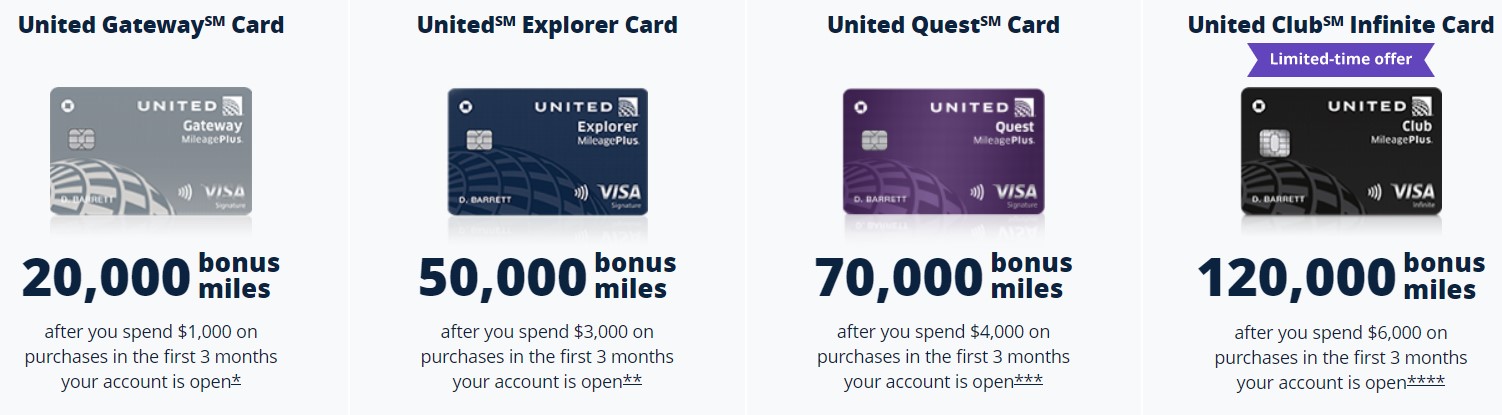

There are 4 personal and 2 business co-branded United Airlines cards, with Annual Fees from $0 to $525. As you can see from the chart below (listing the personal cards), if you use all the benefits, such as the United Club passes/Membership, the Global Entry Fee credit, and free checked bags, the Annual Fee easily pays for itself. If you’re interested in the top tier card and can get a business card, the Annual Fee is $450 instead of $525 – look for “Are you a Small Business Owner?”

Best Hotel Credit Card for Travel

My #6: World of Hyatt

Fantastic sign-up bonus! Good for at least 12 free nights.

I am truly excited about my new Hyatt card! With the sign up bonus and automatic free nights, you can get up to 12 free nights staying at Hyatt properties. There are many other perqs, here; for a $95 annual fee, you can get fantastic value from this card. Other benefits include:

- 4 Bonus Points per dollar at Hyatt

- 2 Bonus Points per dollar at restaurants, airline tickets, commuting, and gyms

- 1 Bonus Point for each $1 USD spent on all other purchases

My #7: Capital One Venture X

My newest card, I haven’t even earned the Sign Up Bonus yet! Why I’m excited about this card:

- Earn 10X miles on hotels and rental cars, and 5X miles on flights booked through Capital One Travel, plus unlimited 2X miles on all other purchases.

- 10,000 bonus miles added each year, automatically.

- Miles never expire.

- $300 annual travel credit

- Global Entry/TSA PreCheck statement credit – worth $100

- Priority Pass membership to airport lounges; includes Capital One lounge access AND – your authorized users can use the lounges too, all free!

The SUB is 75,000 miles when you spend $4000 in the first 3 months. The Annual Fee is $395; as you can see, the value of the benefits surpass the AF.

My #8: Bilt

OK, actually, Bilt is my newest card; I applied a few days after the Venture X…why? (Not generally recommended to apply again so quickly…) PAY RENT WITH NO FEES!

Rewards hackers who pay rent – usually the largest monthly bill – can now use this new Mastercard that allows earning points for paying rent, and to earn them with no fee! These points can be redeemed for flights and hotels – awesome.

Of course, it’s been possible to pay rent using third-party payments from companies like Plastiq, BUT the fees charged usually outweigh the value of the points earned. There are no fees when using Bilt to pay rent – plus, no annual fee!

The Bilt Rewards card isn’t just for rent. Since it’s a Mastercard, it can be used anywhere Mastercard is accepted. Bilt earns:

- 3 points per $1 spent on dining

- 2 points per $1 spent on travel

- 1 point per $1 spent on rent – up to 50,000 points annually

- 1 point per $1 spent on all other purchases

To earn points, the Bilt card must be used 5 times within the month (no minimum purchase). My plan, besides a couple of meals or so per month? Load my Amazon account with $1 every so often.

The major point: fee-free points earned on rent, usable for travel.

Transfer points to a growing list of airlines; so far: United, Delta, American Airlines, Aeroplan, Air Canada, Air France, Emirates, KLM, Turkish Airlines, Hawaiian Airlines, Virgin Atlantic, and JetBlue. Hotels: Hyatt and IHG.

Other benefits include cell phone protection, purchase protection, DoorDash and Lyft benefits, trip cancellation/interruption/delay, and no foreign transaction fees. You can also use Bilt points toward a down payment on a house! and they can even pay you interest on your accrued points.

Check out ALL the detail on the Bilt Mastercard info page.

My #9: Discover

Not a *great* travel card, Discover is an excellent card if you like cash back instead of miles or points. You’ll get a $50 statement credit when you apply through this link. This card has 5% cash back on rotating categories – and, the new Discover It card will match your cash back earnings for the entire first year.

Amazon Hack

You can use your Discover, Chase, AmEx, Capital One, Citi, or Hilton points to make purchases on Amazon.com – even just one point! – Check this link often; sometimes you also get amazing Amazon Discounts when you use credit card points.

Want to Save this Info? Pin for later:

Credit Card Info for Travel

What do you think? I’ll put more suggestions here as they occur to me. Please note that the banks are increasing benefits in response to losing customers during Covid, and that the bonuses and terms I’ve written about in this article can change at any time. In the meantime, there are many business cards which are fantastic for travelers. If you need to know how to get business cards without a traditional business, or for more info on which are great business cards, please reach out for more info.

Furthermore, if you are a US citizen with good credit, you can earn real cash each month with your credit cards with credit sharing – check it out!

Did you sign up for my newsletter yet?

Questions or comments about credit cards? What are your favorites?

Sign me up for newsletter please.

Wonderful information. Thank you!

A wealth of information! I learned so much about which cards give what.Willl definitely start employing what Ive learned here today.

I love the Chase Sapphire Preferred travel card! In fact we’re flying for free this summer with our travel points. How were you able to post their card on this site? When I contacted them to ask about it, they said they aren’t looking for affiliate partners at this time. Do I need to get more traffic to my blog first?

Hi Linda, I’m an affiliate through a credit card clearing house, which does require a certain amount of traffic, not Chase specifically.

Great info! I use debit cards and electronic and online banking but don’t use credit cards.

Great information! I love my credit card rewards!

Use of credit cards for travel perks is great is you can manage it properly.

Great tips!

I definitely have to take a better look into which Canadian cards will give me the best rewards.

Love Chase cards, which earns you travel miles too!

I love my Chase cards! My favorite is the Sapphire Preferred also. So worth it!

Great list of options broken down very well!

I love using my CC for mileage – hoping now one day I will be able to fly somewhere!

Helpful info! I like Chase cards and the ones where you can get the miles for travel!

So excited to get the Amazon discount through my Discover card! Thank you!!

I will be looking for a new card soon & so this is a great list. I’ll be checking back with it soon.

I’ve paid for some nice vacations with points and rewards!

Great options. I find discover my best one yet.

Great options! I recently got a Discover travel card-they match the points after a year!

Great post. I love my Chase Sapphire and Chase freedom cards. My husband and I are pretty minimal about having credit cards we don’t like to have too many. It’s great to know my top two made the list!

The fact that you can earn money with these credit cards is so interesting to me. You’ve done a great job comparing them, too.

Good comparison listing.

It’s always nice making your cards work for you!

I got free cash from the Chase card recently. It really does work!

I just got a good deal with Hilton and I love my Marriott card as well. Chase is my favorite cards.

Those are all really good choices to choose from and who doesn’t love getting perks right? lol 😂 or freebies in some way or another especially when you’re spending money for something else. Thanks for sharing!

I actually have one of those cards! I’ll have to look into all it offers!

Sounds like you have researched lots of cards for points. I love using hotel points, etc.

Enjoyed the article – it’s a wealth of information, so thanks for sharing!

What the heck?! Just applied for a Southwest card too…love that airline.

Great info! I used your link for the Chase Freedom. Thanks.